Choosing the best investment options in 2026 is essential for anyone looking to grow wealth and secure financial stability. With changing markets, new technologies, and global economic shifts, investors need smart and diversified strategies this year.

1. Stock Market (Equity Investment)

The stock market continues to be one of the most powerful wealth-building tools in 2026. With rapid innovation in AI, green energy, biotech, and technology, many sectors are experiencing strong growth.

Why invest in stocks?

-

High long-term return potential

-

Ownership in growing companies

-

Dividend income opportunities

Best sectors to watch in 2026:

-

Artificial Intelligence & Automation

-

Renewable Energy

-

Electric Vehicles (EV)

-

Semiconductor Industry

-

Healthcare & Biotech

Best for: Long-term investors with moderate to high risk tolerance.

2. Mutual Funds & SIP (Systematic Investment Plan)

For beginners, mutual funds remain one of the safest and most convenient options. SIP allows you

to invest small amounts regularly, reducing market risk through disciplined investing.

Benefits:

-

Professionally managed

-

Diversified portfolio

-

Low starting investment

-

Ideal for beginners

In 2026, index funds and ETFs are especially popular due to low fees and steady performance.

Best for: Salaried individuals and new investors.

3. Fixed Deposits (FD) & Bonds

If you prefer stability and guaranteed returns, fixed deposits and government bonds are still reliable choices in 2026.

Advantages:

-

Low risk

-

Fixed interest returns

-

Capital protection

Though returns are lower compared to stocks, they are ideal for conservative investors or retirees.

Best for: Risk-averse investors.

4. Real Estate Investment

Real estate remains a strong long-term investment option. With urban expansion and smart cities development, property demand continues to grow.

Options in 2026:

-

Residential properties

-

Commercial spaces

-

Real Estate Investment Trusts (REITs)

-

Rental income properties

If buying property feels expensive, REITs allow you to invest in real estate with smaller capital.

Best for: Long-term wealth builders.

5. Gold & Digital Gold

Gold has always been a safe-haven asset during economic uncertainty. In 2026, investors prefer digital gold, gold ETFs, and sovereign gold bonds.

Why invest in gold?

-

Protection against inflation

-

Safe during market volatility

-

Easy liquidity

Gold should be part of a diversified portfolio, not your entire investment strategy.

Best for: Portfolio diversification.

6. Cryptocurrency & Digital Assets

Cryptocurrency remains a high-risk, high-reward investment in 2026. While the market has matured, volatility still exists.

Popular options include:

-

Bitcoin

-

Ethereum

-

Stablecoins

-

Blockchain-based projects

Before investing, always research thoroughly and invest only what you can afford to lose.

Best for: High-risk investors seeking high returns.

7. Public Provident Fund (PPF) & Retirement Plans

For long-term savings and tax benefits, PPF and retirement funds are strong options in 2026.

Benefits:

-

Tax advantages

-

Safe government-backed returns

-

Ideal for retirement planning

These are excellent for building disciplined long-term savings.

Best for: Retirement-focused investors.

8. Exchange-Traded Funds (ETFs)

ETFs are gaining popularity due to:

-

Low expense ratios

-

Easy trading like stocks

-

Diversification

In 2026, sector-specific ETFs (AI, clean energy, global tech) are trending among investors.

Best for: Cost-conscious investors.

How to Choose the Best Investment in 2026?

Before investing, consider:

✅ Your financial goals

✅ Risk tolerance

✅ Investment duration

✅ Current income level

✅ Emergency fund availability

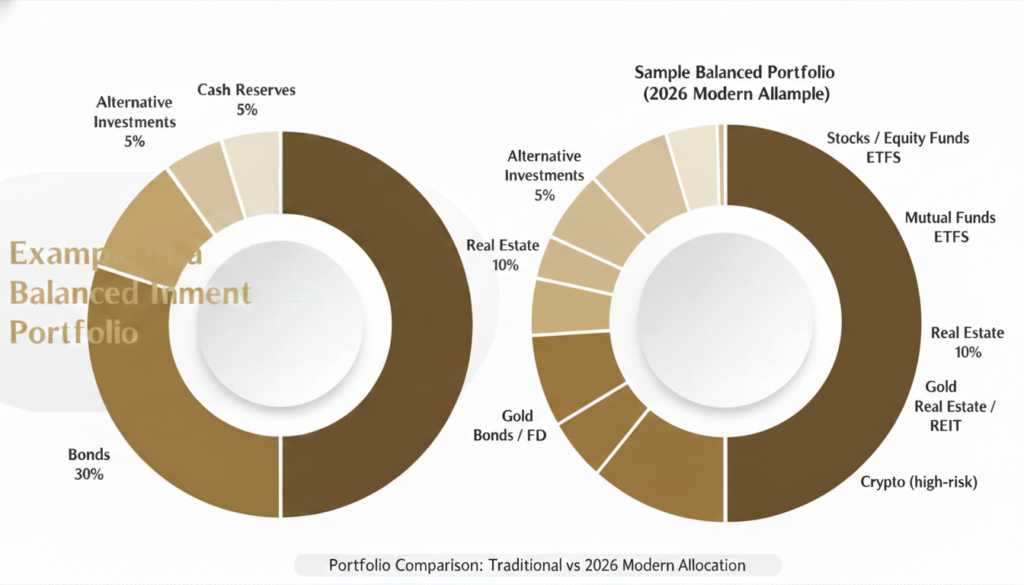

A smart strategy is diversification — spreading your money across different assets to reduce risk.

Sample Balanced Portfolio (2026 Example)

-

40% Stocks / Equity Funds

-

20% Mutual Funds / ETFs

-

15% Bonds / FD

-

10% Gold

-

10% Real Estate / REIT

-

5% Crypto (optional high-risk portion)

Final Thoughts

The best investment option in 2026 depends on your goals and risk appetite. There is no “one-size-fits-all” strategy. A combination of equity, safe assets, and emerging investments can help you build wealth steadily.

Start early, stay consistent, and think long-term. The power of compounding works best with time and discipline.

According to global financial trends reported by the World Bank, diversification remains key to stable long-term growth. For More Information : https://www.worldbank.org/ext/en/home